New Chinese baby formula plant to buy Canadian milk — but at what price?

'It complies with all of our trading obligations,' dairy spokesperson says

A $225-million investment from a leading Chinese dairy processor is set to launch Canada back into the export game at a time when several of its major competitors are threatening a trade challenge over Canadian dairy prices.

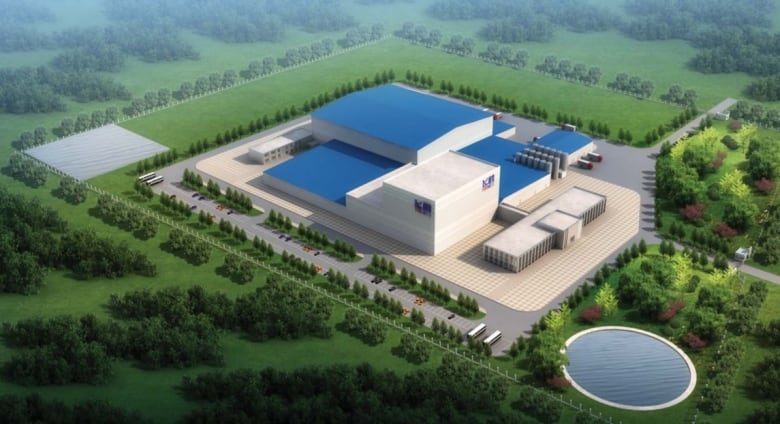

Feihe International's infant formula plant, now under construction in Kingston, Ont., plans to manufacture up to 60,000 tonnes of dry infant food annually, using milk from Canadian farms.

About 85 per cent of the baby formula will be shipped back to China to feed an anticipated baby boom, as the country's one-child policy phases out.

"It was a signal that the Canadian dairy industry is open for business, that other countries want to come to do business in our industry," said Graham Lloyd, the general manager of the Dairy Farmers of Ontario.

Open for business, but not everyone agrees the price they're going to charge is fair.

The stakes are high. Canada's dairy industry is bracing for more competition when the EU trade deal takes hold this September. Canada is under pressure from the U.S. and others to open its tightly regulated market even more in upcoming trade negotiations.

The new plant creates jobs. The demand for milk will rise. But it's good news for another reason.

Feihe will separate cream from the skim milk it uses for formula. Other processors need it.

"Right now we have an overwhelming demand for cream and butterfat, in fact an unprecedented demand for it," Lloyd said.

That's the win-win situation the Canadian Dairy Commission envisioned when it set out to attract a new formula maker.

'Hand-holding'

It's been several decades since Canada courted new export markets for dairy. World Trade Organization changes in the early '90s dramatically limited what supply-managed agriculture sectors could ship.

But as consumers rediscovered a taste for real butter and cream, Canada needed more uses for non-fat milk.

Selling skim milk powder internationally is "not a great market," said CDC spokesperson Chantal Paul. "It was also clear, given what was happening at the WTO, that eventually we would not be able to do subsidized exports of skim milk powder."

Documents obtained by CBC News under Access to Information lay out the CDC's Chinese courtship, dating back to April 2016. CEO Jacques Laforge and his team travelled to China. They also hosted multiple Chinese visitors, touring potential sites in Quebec and Ontario.

The CDC opened doors for Feihe, connecting it with food inspection and health regulators as well as provincial counterparts.

"We did a lot of hand-holding," Paul said.

'We're satisfied it complies'

In today's precarious global dairy market, any country would envy a foreign investment like this. But it's the pricing offered to this new business that may prove controversial.

Canada is already under fire internationally for "class seven," a new dairy price category rolling out with what the industry calls its "ingredient strategy."

The stable, often higher prices maintained for Canada's farmers were problematic for processors competing internationally.

Canada's industry wanted to kill the incentive to use lower-cost diafiltered or ultrafiltered milk from the U.S. Because diafiltered milk is a new product not covered under current trade rules, it comes in duty-free.

Facts on the ground suggest the strategy is working. Imports of U.S. ingredients dropped. Donald Trump wasn't amused.

When U.S. agriculture secretary Sonny Perdue visited Toronto in June, he called class seven a "very unfair, underhanded circumvention" of WTO rules. Other major dairy producers — New Zealand, Australia and the European Union — agree and threatened a trade challenge last fall.

So, what price will the Chinese plant pay for its milk? Lloyd from the Dairy Farmers of Ontario told CBC News that "class seven" pricing applies.

"They had a choice to go to any country in the world and they chose Canada because of the ability for us to supply the milk and it's known to be of the highest-quality — safe, reliable milk," he said. "We're always surprised at how other countries are concerned about our system."

Far from flooding markets, Canada is actually a net importer of dairy, he said. The U.S. has a half-billion dollar trade surplus with Canada.

"I don't anticipate a challenge," Lloyd said. "We're satisfied that it complies with all of our trading obligations."

Low profile

There hasn't been a lot of publicity about this deal. Feihe declined an invitation to be interviewed by CBC News. While a CDC spokesperson answered questions over the telephone, its CEO declined to be interviewed.

A document obtained by CBC News under Access to Information shows that a confidentiality agreement was signed between the company and CDC in Ottawa last September — the same week Chinese Premier Li Keqiang met Prime Minister Justin Trudeau and announced exploratory trade talks. A later document doesn't mention this signing.

Another letter from CEO Laforge to Ontario government ministers ahead of Li's visit suggested the Feihe plant would be among the Canada-China partnerships highlighted by the two leaders. But when the day came, the Feihe plant wasn't on the list of agreements the Canadian government publicized.

The documents shed some light on how much taxpayers are contributing to the deal.

Feihe International is a corporation registered in the Cayman Islands. Its new Canadian subsidiary is incorporated as Canada Royal Milk, so it can access the same government funding available to domestic processors.

Feihe has been approved for two federal programs: the milk access for growth program, which allows it to buy milk, and a matching investment fund, which offers non-repayable contributions to companies that innovate. The dollar amount wasn't specified in the non-redacted portions of the documents.

The city of Kingston isn't allowed to offer financial incentives to attract manufacturing. But large-scale food processing investments in Ontario can receive grants averaging between 10 and 15 per cent of the eligible costs of the total investment ($225 million in this case).

Another letter in the Access to Information release flags a discrepancy between what the Ontario government offered as a grant, $13.4 million, and what the Chinese expected to receive, which is nearly double that amount. The documents don't show if or how this was resolved.