Why you should care about the Alberta budget, even if you don't live there

This is a fiscal milestone that matters for all Canadians, according to Trevor Tombe

This column is an opinion by Trevor Tombe, an economist at the University of Calgary. For more information about CBC's Opinion section, please see the FAQ.

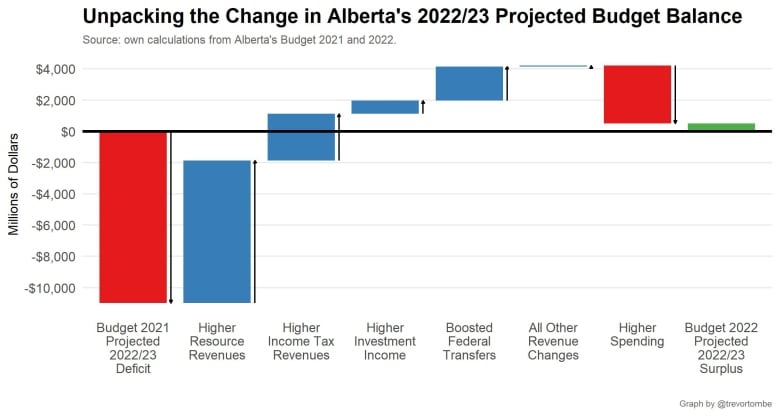

From a projected deficit of $18.2 billion in February 2021, to a surplus of more than $500 million in February 2022, Alberta's fiscal turnaround is nothing short of remarkable.

Revenues are set to rise $19.5 billion for 2022 compared to 2020 (a 45 per cent boost!), mostly due to high oil prices. The government, after all, gets a cut of each barrel sold. Revenues from oil and gas royalties alone are projected to be $13.5 billion — the highest in Alberta's history. Add in higher income tax revenues, investment income, and federal transfers, and the previous deficit quickly evaporates.

What's more, the budget likely understates how dramatically Alberta's fiscal situation improved.

The government is banking on oil prices averaging $70 US per barrel this fiscal year. But current prices are well above $90 per barrel, and futures markets suggest that an estimate of $85 per barrel this fiscal year would have been entirely defensible. At that price, Alberta's surplus for 2022/23 could exceed $8 billion.

This rapid turnaround in Alberta's fiscal fortunes — easily the largest in the province's history (however you want to measure it) — obviously matters for Albertans.

But Canadians everywhere should also care. Here's why.

Canada (mostly) gains from high oil prices

First, the benefits of high oil prices extend beyond Alberta.

It is understandably hard to appreciate these gains when faced with pain from high gasoline and home heating prices. But they're real.

Higher revenues for — and therefore spending by — the oil and gas sector benefits countless suppliers spread throughout the country. Indeed, recent research suggests only New Brunswick may be economically harmed by high oil prices.

The federal government also stands to gain.

The reason is simple: higher oil prices increase corporate profits in the sector and each additional dollar in profits translates into 15 cents of revenue to the federal government. Plus there are spillover benefits to worker income, supplier sales, and so on.

It's tough to be precise, but based on a 2015 report by the Parliamentary Budget Office I estimate that a $30 per barrel higher oil price translates into an approximately $5 billion decrease in the federal government's deficit.

That's a lot. It's more than the entire planned federal spending on the new childcare initiatives now rolling out across the country, for example.

Health spending on the rise

Second, two years of pandemic-induced strain on health systems, combined with an aging population, means provincial health expenditures will have to rise.

And if there's any provincial government less likely to accommodate those pressures, it's Alberta's. Since 2019, Alberta's government has held health expenditures constant (excluding temporary COVID-related spending) and engaged in fiery rhetoric against any and all critics of this policy. But in Budget 2022, even Jason Kenney and the UCP abandoned this approach.

The spending increases were large. As recently as November 2021, the government was planning to hold health-care spending constant until 2024. Now, it plans to spend $600 million more in 2022/23, $1.2 billion more in 2023/24, and $1.8 billion more in 2024/25. That's a nearly 8.5 per cent boost within three years.

This isn't just inside baseball for Alberta political nerds. For Alberta's government to abandon its previous fiscal plans — despite years of aggressive cost cutting — suggests these pressures are difficult for any provincial government to resist.

Alberta's 2022 budget may signal what's to come across the country.

Weakens arguments against equalization

Third, Alberta's budget surplus makes an undeniable fact clear for all to see: Alberta is able to fund public services at lower tax rates than other provinces.

Alberta can balance its books with tax rates roughly one-third below the national average and spending levels aligned with other large provinces. This is, of course, largely — but not exclusively — due to reliance on natural resource revenues.

This matters for ongoing debates about Canada's equalization program.

For years, critics of the program observed that Alberta had a massive deficit and received no equalization payments. Meanwhile, the argument went, Quebec had a surplus and received the lion's share of such payments. For some, this was enough to conclude the program was unfair.

Even informed critics held this view, including — conveniently — a former Alberta finance minister following last year's deficit-laden budget.

With Budget 2022, that argument falls apart with no deficit to point to. In fact, a surplus opens the door to the reverse position. Even Premier Kenney regularly notes that "Albertans are happy to share some of our good fortune when times are good here."

Of course, a province's actual budget balance means next to nothing for who receives and who doesn't under the equalization program. Instead, what matters is a province's ability to raise revenues, which is called its fiscal capacity. Alberta has always had the highest fiscal capacity in the country — even in tough times. (Here's a useful explainer.)

This budget makes transparent what many have known all along. It provides a strong counterargument against claims that equalization treats Alberta unfairly.

Provincial police and pensions

Finally, a surplus may encourage the government to pursue a long-held desire to create a separate Alberta provincial police force and Alberta pension plan.

There are pros and cons to each idea, to be sure, and I won't get into that here. But they don't come cheap. A provincial police force, for example, means losing federal subsidies (currently $170 million per year) and incurring transition costs that could approach $400 million, according to a recent PricewaterhouseCoopers report.

For Canada, the most relevant and pressing cost would result from Alberta leaving the CPP.

Alberta has a disproportionate share of younger workers. If they were no longer contributing to CPP, then contributions from workers in other provinces would have to increase to make up the difference. It's hard to say how much, but the effect likely isn't small.

With fiscal fortunes improving in Alberta, and an election on the horizon early next year, both ideas might have become a little more likely.

Concluding thought

Alberta's budgets are always interesting documents. Riding the royalty roller-coaster makes for dramatic swings, both up and down.

Successive governments have done little to dampen these swings by … oh, I don't know … saving resource revenues rather than spending them. Perhaps one day Alberta's governments will turn their attention toward a longer-term future. But in the meantime, Alberta is exposed to shocks far beyond its control — with implications right across the country.

Today, the latest budget features a lot of good news — and some of that will spread throughout the country. But it also points toward mounting strain in healthcare that some provinces might struggle to manage. And beyond the dollars and cents, Alberta's added fiscal flexibility may change the way it engages with the federation.

In short, Alberta's 2022 provincial budget is a fiscal milestone that matters for all Canadians.

Do you have a strong opinion that could add insight, illuminate an issue in the news, or change how people think about an issue? We want to hear from you. Here's how to pitch to us.