N.W.T. scrapping consumer carbon tax following federal cancellation

Change comes into effect April 1, last offset payment also in April

The Northwest Territories is cancelling its consumer carbon tax following the federal decision to kill the tax last Friday.

The N.W.T. is one of three provinces and territories that has its own carbon tax legislation, something Finance Minister Caroline Wawzonek said would allow the territory more flexibility to adjust how the tax is applied to northerners. That means federal changes don't automatically change the territory's legislation, and the N.W.T. needs to undertake its own process.

The N.W.T. government isn't able to repeal the Carbon Tax Act since the legislature isn't in session. Instead, it's making changes to set the tax value to zero — effectively ending the tax without formally repealing the act.

Both the territorial and federal changes will come into effect April 1, with N.W.T. residents to receive their last quarterly cost of living offset (COLO) payment in April.

Carbon pricing has been heavily criticized for punishing Northerners who don't have more ecological alternatives for heating their homes, despite COLO payments that some politicians say have reimbursed residents "significant amounts."

How will it impact consumers?

Cancelling the tax will mean a drop of about 20 cents per litre at the pump.

If gas prices are $1.629 per litre — as they were at one Yellowknife gas station March 18 — then without the $0.176 tax ($0.185 with GST), consumers will pay $1.44 per litre.

In February 2024, the territory announced a carbon tax exemption on diesel for home heating fuel. For those who heat their homes with propane, they'll save about $0.123 per litre without the tax.

But changes also mean residents will no longer receive rebates.

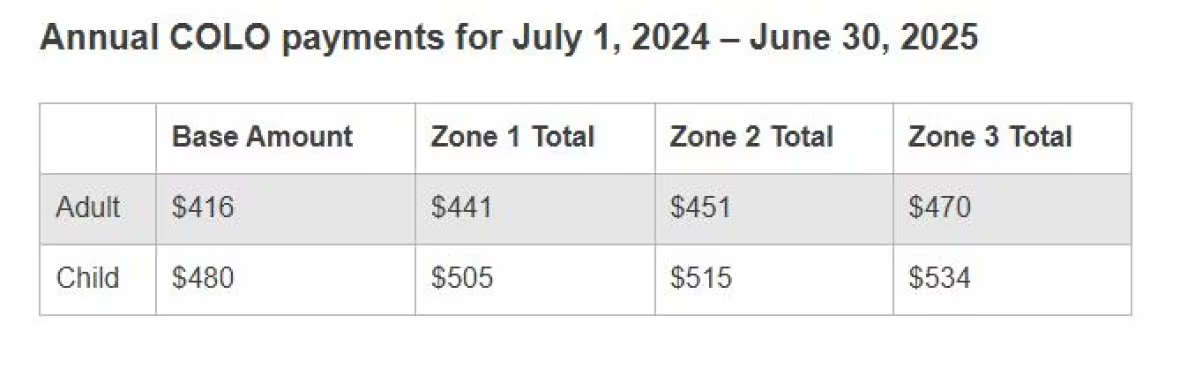

Those payments came four times a year in July, October, January and April with a tiered system that had residents farthest north receiving the highest offset payment.

A family of two adults and three children in Paulatuk, for example, had been receiving annual deposits of $2,542, paid quarterly. They will no longer receive those payments after the final payment in April.

The government of the Northwest Territories had also expected to earn about $11 million in net carbon tax revenues. In the 2023/24 fiscal year, the territory collected $14 million in net revenue. It used the revenue to invest in emission-reduction projects, with some of that money distributed to communities helping to reduce property tax hikes in Yellowknife.

Revenue from the tax has also helped pay for a 3.5-megawatt solar plant at Diavik Diamond Mine through the large emitter grant program.

'Northerners want this off the books'

MLAs have voiced concerns and critiques of the tax since it was introduced, saying it makes life less affordable for residents — especially those in smaller communities.

Yellowknife MLA Kieron Testart went as far as introducing a bill to repeal the carbon tax, which passed second reading and is in a committee review stage.

On March 13, he again told the assembly that the N.W.T. should adopt the federal legislation to be ready for Prime Minister Mark Carney's plan to scrap the tax.

"Northerners want this off the books. They're tired of paying a consumer carbon tax ... We shouldn't be waiting. We should be moving," he said.

The finance minister and department staff declined an interview. In an email, the department said the territory doesn't need to adopt federal legislation because its structure allows for immediate changes when the federal system is changed, "as is being demonstrated by the Northwest Territories changes coming into effect on the same date as the federal changes."

The changes don't apply to large emitters, like mines, which will continue to pay the tax and receive a 72 per cent rebate. A Finance spokesperson could not say how much the change will impact the government's revenues, but said there will be a loss that will reduce the territory's projected $170-million operating surplus.

Federal Conservative Leader Pierre Poilievre has said he would remove the carbon tax on heavy emitters too, if elected.

Corrections

- A previous version of this story said the COLO payment to a Paulatuk family of two adults and three children would be $2,542 quarterly. In fact, that payment would be the annual amount, paid in quarterly installments.Mar 19, 2025 6:54 PM EDT