Waiting for a big, big shoe to drop: Why Confederation Building needs to show the books

While a budget may be delivered soon, an influential financial voice has issued a chilling note

Finance Minister Tom Osborne may have had a news conference on Thursday for a long, long-awaited fiscal update, but a telling financial picture had actually been painted the week before.

That's when Standard and Poor's had issued a pointed statement about the terrible shape of Newfoundland and Labrador's finances.

Standard & Poor's may not be a household name, but the rating agency is well known in the halls of power the world over. Since the Victorian era, the company has been judging the fiscal performance of governments and corporations, and its decisions are weighty: its ratings determine what interest rates that, say, a beleaguered province on the East Coast of Canada can get when it needs to borrow money, and thus what it must cough up as it pays back the debt. (I realize the last part of that sentence is rather aspirational.)

The latest S&P release on Newfoundland and Labrador? It was harsh.

"We are revising the outlook to negative from stable," the company said in a May 28 assessment. (Moody's, another agency, moved N.L. to "negative" in an April announcement. The third agency the government uses, DBRS, is still listed as "stable.")

Standard & Poor's reasons why will not surprise you.

"We expect the two-pronged shock of the pandemic and deflated oil prices to exert pressure on the [province's] budget deficit, more than unwinding the budgetary improvements it had achieved since the last oil price shock," the company wrote.

D is for deficit

There may be no surprises in that statement, but there's a word in there — deficit — that speaks to something that's been hovering over Confederation Building, not to mention the province itself.

We actually have no idea what the projected deficit is for this fiscal year. The government usually brings down a budget in April. Last year, we got two: the Liberals reintroduced their April budget in June, after winning a new mandate in the general election that fell in between.

For weeks now, the government has been asked about when a new budget might emerge. Premier Dwight Ball has shown little enthusiasm for drumming one up.

"The budgets that [provincial governments] would have put in place before this pandemic [are] not really worth the paper that was written on," Ball said at a May 4 COVID-19 briefing, noting other premiers have felt the same way.

Ball had a point: the variables at play — massive numbers of people who have been laid off, businesses that have been ordered to close, and wild fluctuations in commodity prices — are considerable, and quite fluid.

But that doesn't mean that the public should not see the ledgers, at least as a snapshot in time. It's hardly like any budget can be relied upon to be an accurate projection of what will happen in the year to come: year upon year, there are mid-year revisions, not to mention retrospective updates that are more like a post-mortem than a look ahead.

The year was worse than expected

That in fact is what Osborne's update focused on: the not-surprising but still chilling determination that the 2019-20 fiscal year was worse than expected. Revenues were down by about $690 million from what was expected last June. It's worth noting that the pandemic's effect was, relatively speaking, minor, as the shutdown happened in the last two weeks of the fiscal year.

As for this year, Osborne said at least that a budget is in the wings.

"While we are not in a position to provide you with a firm 2020-21 forecast, my commitment is that we will table a budget as soon as possible," Osborne said Thursday.

So, there's that.

Osborne's variables are dizzying, although the sensation of knives falling at every turn seems to have abated. The province moves into what's called Alert Level 3 on Monday, as we move into another "new normal" in the COVID-19 pandemic that led to a shutdown in mid-March. More businesses will open, putting some more pep into an economy that is unrecognizable from, say, a year ago.

But there are huge headaches. While oil prices are gradually recovering — Brent crude was trading Friday morning around US $41, the highest it's been since early March, when prices were dropping like an anvil — the industry is in hard, hard shape. This is a month of pink slips for hundreds of well-paid workers connected to Hibernia, the project that produced first oil in 1997 and kick-started an industry that transformed the face of the province.

Oil has also transformed our economic structure, and notably turned Newfoundland and Labrador away from being a "have-not" province — that is, one that receives payments from the federal equalization program.

That happened in November 2008.

The economy here has been in rough shape for years now, but Newfoundland and Labrador is still — on paper — a "have" province.

Osborne underscored that very point on Thursday, and pointed out that there's something askew in how equalization is worked out.

"If you'd remove equalization from either of the other three Atlantic provinces, their fiscal situation would have been very similar to ours over the last three or four years," Osborne said.

"That's what I mean by fairness — equalization has not lived up to its intent under the Constitution, the 1982 Constitution, which very clearly articulated that equalization is meant to provide a comparable level of services at a comparable level of taxation."

Next plan willl hang on 'federal assistance'

We don't know what the government will unveil in its budget, but Osborne made one thing clear: "Our path forward requires federal government assistance."

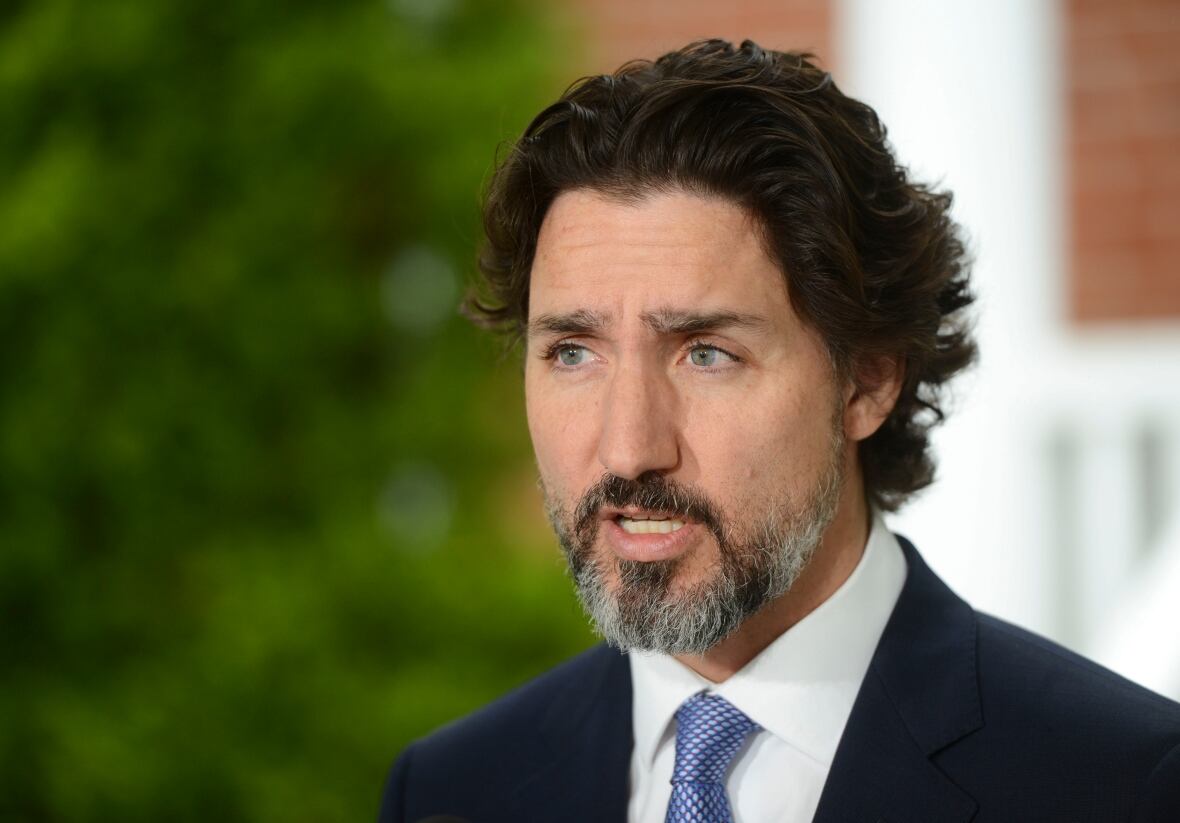

Prime Minister Justin Trudeau's daily COVID-19 briefings have involved multibillion-dollar expenditures; on Friday alone, he announced a $14-billion plan for the provinces and territories to help them "safely and carefullly" reopen their economies, although there are few details so far on what that will look like.

Perhaps N.L. will have success tapping into that. It's likely, though, the province will be looking for some kind of fiscal stabilization package. Still, the federal ledger is deep into the red now, too, and the demands keep growing.

Meanwhile, Alert Level 3 is not the only thing happening on Monday. The suspended Liberal leadership race will become official once more. We'll know Aug. 3 whether John Abbott or Andrew Furey will succeed Ball as premier.

It's more than possible that the change at Confederation Building will trigger a financial reckoning.

It's also more than possible that the key word in Standard & Poor's statement — "negative" — will be a theme of a government grappling with a host of problems, including how to manage its spending.