OPINION | Alberta, get ready for higher taxes

PST and provincial carbon tax should be on the table, says economist

This column is an opinion from Trevor Tombe, an associate professor of economics at the University of Calgary.

After the COVID dust settles, Albertans will pay higher taxes.

And despite not having explicitly said so, our provincial government has already committed us to this path. As 2021 unfolds and we gradually put COVID-19 behind us, we'll need to come to grips with Alberta's new fiscal reality.

For many years now, Alberta's governments struggled with persistent deficits. The former NDP government banked on rising oil and gas revenues to solve the problem, while the current UCP government hoped spending cuts would do the same.

Today, neither strategy is enough and we must soon change course.

We're already seeing some recognition of this. In its recent November fiscal update, Alberta announced what are called "fiscal anchors" (guideposts to keep fiscal policy on track). They effectively provide a new foundation for Alberta's budget planning:

- Align public spending with 'comparator provinces.'

- Keep debt below 30% of GDP.

- Balance the budget and 'repay' debt over time.

Together, these anchors almost surely mean higher taxes are in our post-COVID future.

Are spending cuts enough?

The first anchor commits Alberta to "align" per capita spending with "comparator provinces."

They do not specifically say who those are, though they likely mean the three other large provinces of Ontario, Quebec and British Columbia. Currently, Alberta spends roughly 20 per cent more than these three provinces per person, on average. But based on currently announced plans by each province, we'll achieve our first anchor within two years.

One can certainly agree or disagree with the wisdom of spending reductions. There are important trade-offs to consider, and the reductions will not be easily achieved. Difficult public sector wage negotiations and lower levels and quality of public services are in the cards.

If spending is successfully lowered, however, it will make a big difference to the province's bottom line. We're facing a projected $10-billion deficit by 2022-23, compared with what I estimate would have been a $20-billion deficit had total expenditures followed the path laid out by the former NDP government in their pre-election fiscal plan from 2019.

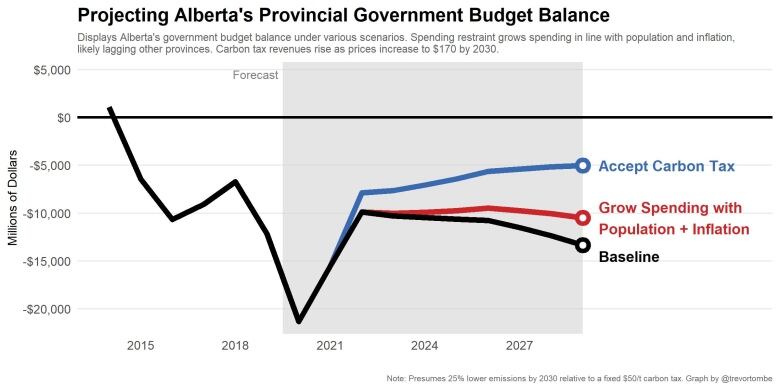

Achieving the first fiscal anchor is therefore roughly half the job. But maintaining spending in line with comparable provinces after 2022 means the $10-billion fiscal gap will persist. Below I plot my own budget projections. (Which updates this recent analysis.)

The government, of course, could opt for greater spending restraint — say, lowering per person spending by another 15 to 20 per cent — but that would violate their first anchor. If we take their commitments seriously, then this option is off the table.

In short, Alberta's "spending problem," as some refer to it, will be solved within two years. But this alone is not enough. We therefore need to look at new revenues as well — and non-resource revenues in particular.

Increasing government revenues

While there are many options — ranging from income taxes, to health levies, to gas taxes, and so on — I'll explore, just for fun, two of the most politically difficult options available: carbon taxes and sales taxes.

Currently, the federal carbon tax is set to rise to $170 per tonne by 2030, with nearly all the revenues rebated directly to households rather than any government's budget. If Alberta takes over this tax, it could instead opt to target rebates only to lower income households and use the rest to shrink the deficit. A rebate system modelled as in British Columbia might mean over $5 billion in carbon tax revenues to Alberta by 2030.

This helps, though still falls short. So consider our next option: sales taxes.

Currently, Albertans pay a five per cent sales tax on most goods and services we buy, with all revenues going to the federal government. Alberta can choose to increase this tax to, say, 10 per cent and the federal and provincial governments would then split the revenues evenly between them. This is known as a "harmonized sales tax," or HST.

If we gradually phased-in this change with a six per cent sales tax starting in 2022, eight per cent by 2023 and finally 10 per cent by 2024, then Alberta would be on track to roughly balance its books by 2025 — midway through the next government's mandate. And, for perspective, a 10 per cent sales tax (five per cent federal, plus five per cent provincial) would be the lowest of any province in Canada. (Saskatchewan's PST plus the federal GST currently totals 11 per cent.)

These options — or something else of roughly equivalent magnitude — would achieve all three fiscal anchors. We would maintain spending in line with (or, indeed, perhaps slightly less than) other provinces, our provincial debt would not exceed 30 per cent of GDP, and over time we would balance the books and begin "repaying" the debt we've recently accumulated.

Securing Alberta's fiscal future

Restraining spending growth, accepting carbon taxes and increasing sales tax rates would not only allow us to overcome our current fiscal challenges but would serve Alberta well over the long run.

The province would continue to be the lowest tax jurisdiction in Canada, and surpluses after 2025 could gradually be used to redirect resource revenues to debt repayment rather than funding public services. Lower debt and finally easing ourselves off the royalty roller-coaster is a tantalizing opportunity.

Tax increases are politically difficult, to be sure, and may explain why the government is only quietly setting Alberta on that path while simultaneously noting that "now is not the time to raise taxes." Of course, it would be inappropriate to increase taxes during what will be a difficult recovery from one of the largest economic shocks in generations.

But that is the path we're now on, and it's never too soon to plan prudently, openly and honestly for the future.

This column is an opinion. For more information about our commentary section, please read our FAQ.