Bad-times budget delivers billions in tax cuts, spending

Flaherty forecasts annual deficits through to 2013, starting at $33.7B

Canada will have to weather large deficits to "do what it takes to keep our economy moving," including cutting taxes while boosting infrastructure and worker training, Finance Minister Jim Flaherty said in tabling the federal budget Tuesday.

Flaherty promises billions of dollars in new spending — ranging from money for infrastructure projects to aid for worker training, and cash for enhanced employment insurance (EI) benefits — to help the country ride out the global economic downturn.

"We must do what it takes to keep our economy moving, and to protect Canadians in this extraordinary time," Flaherty said in his budget speech in the House of Commons.

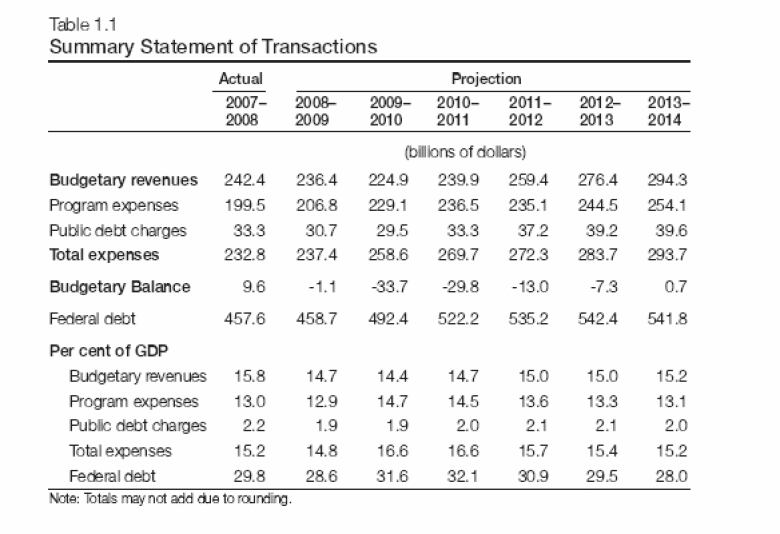

Flaherty's budget plan predicts a deficit of $33.7 billion for the 2009-10 fiscal year and $29.8 billion the following year.

For 2011-12, the red ink would diminish to $13 billion, followed by a deficit of $7.3 billion for 2012-13.

Flaherty later told CBC News that he expects Canadians will begin to see the impacts of the budget and its stimulus package within about six to 12 months.

The Finance Minister said that he is confident the measures in the budget designed to stimulate the economy meet Canada's needs and responds to what Canadians have been asking for. But he added if there is a need "to do more later, we will."

"I made it clear in the budget speech today that we will do whatever is necessary to protect Canadians from global recession," Flaherty said. "If we have to do more later this year — we will do more."

While the big-spending budget is meant to aid the Canadian economy, it will also be key to the survival of Prime Minister Stephen Harper's Conservative government. The minority government needs opposition support to get the budget passed, but opposition parties have threatened to topple the government if they don't believe it is doing enough to aid the economy.

Some business groups said Ottawa had to show Canadians that it had a roadmap for getting out of the current economic mess.

"The amount of the stimulus is not that important, compared to the fact that the government has a plan and is dealing with the problem," said Perrin Beatty, former Conservative cabinet minister under Brian Mulroney and president of the Canadian Chamber of Commerce.

Tax cuts on block

For individual taxpayers, the government promises to boost the basic personal amount – which would allow people to earn more before they have to pay federal tax. The basic amount would go from $9,600 in 2008 to $10,320 for 2009.

The government also plans to raise the upper limits on the two lowest income tax brackets. The upper limit for the 15 per cent bracket would go to $40,726, while the upper income limit for the 22 per cent bracket would rise to $81,452.

The tax changes would cost about $1.9 billion for the 2009-10 fiscal year, and almost $2 billion the following year.

Those changes won plaudits from tax watchers, but were still considered modest by some.

"Our tax rates compared to other countries are a bit on the high side," said Todd Miller, a tax lawyer with the Toronto office of McMillan LLP.

Help for current, wannabe homeowners

Flaherty also promised action to stimulate the housing sector.

A new home renovation tax credit would give up to $1,350 in tax relief on home improvement projects. The eligible expenses must be at least $1,000, but not more than $10,000, and the work would have to be done between Jan. 27, 2009, and Feb. 1, 2010.

The temporary credit would cost the government an estimated $2.5 billion for the upcoming fiscal year.

Infrastructure, EI priorities

As promised in the days leading up to Flaherty's announcement, the budget includes billions of dollars earmarked for infrastructure spending.

The federal government is promising $4 billion over the next two years for projects beginning construction in the 2009 and 2010 building seasons. The government said it would approve provincial, territorial and municipal projects, and cover up to 50 per cent of eligible project costs.

"Since Sir John A. Macdonald laid a railway across a continent, infrastructure has been both an immediate response to an urgent need and a hopeful act of nation building," Flaherty said.

With job losses expected to rise as the economy struggles, the government is proposing changes to the EI program.

For Canadians hit by layoffs, the government plans to extend maximum EI benefits by five weeks, bringing it up to a maximum of 50 weeks. The measure would be in effect for the next two years, at a cost of $1.15 billion.

Another $500 million over two years is set aside to extend EI benefits for Canadians participating in longer-term training programs.

Government shares ‘regret’ to run deficit

"Canadians regret the need to run a deficit in order to invest in our economy," said Flaherty. "Our government shares that regret.

"We have chosen this course because we know it is what Canadians families and businesses need," he said.

Canada is expected to run deficits until 2013, when a $700-million surplus is forecast.

While the government is promising billions of dollars in spending to boost the economy, Flaherty hinted there could be more to come if deemed necessary.

"While our projections are based on the best information available, we cannot guarantee them absolutely," Flaherty said. "Forecasters all agree that there is substantial uncertainty, so some flexibility is advisable."

Economist Jeff Rubin of CIBC World Markets called the government's approach to its handling of the economic situation a "sea change.

"Government has now returned to taking a leadership in the economy," Rubin said.

The government is assuming the economy will contract by 2.7 per cent in 2009, which is worse than the 1.2 per cent drop that is the average of private-sector forecasts.