Secret tax deal for wealthy KPMG clients sparked anger inside Canada Revenue Agency

Canada Revenue Agency offered amnesty in $130 million offshore 'sham'

A high-level decision to offer amnesty to wealthy KPMG clients caught using an offshore tax-avoidance scheme on the Isle of Man sparked anger inside the Canada Revenue Agency, a CBC News/Radio-Canada investigation has found.

Several officials felt the CRA should have at least tried to impose large penalties on these wealthy clients of the accounting firm, CBC News has learned.

Some felt the agency should also have pursued a criminal investigation into the KPMG tax plan, which, in court documents, the CRA has alleged is a "sham."

"No one is happy about that decision, no one," a source told CBC News.

- Canada Revenue offered amnesty to KPMG clients in offshore tax 'sham'

- KPMG offshore 'sham' deceived tax authorities, CRA court documents allege

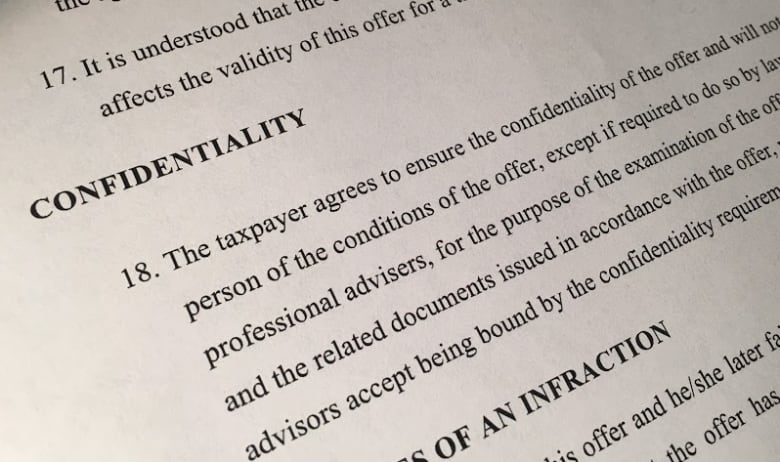

- Read for yourself CRA's May 2015 offer to KPMG clients

The offer, which was dated May 1, 2015, means at least 15 wealthy KPMG clients will avoid any "gross negligence" penalties, fines or criminal investigations as long as they pay back taxes and some modest interest on the income they had failed to report on their tax returns over many years.

Court records indicate that at least 26 clients parked more than $130 million offshore in the KPMG scheme.

CRA violated own guidelines

CRA has what is called a voluntary disclosure program, which provides an amnesty for taxpayers who come forward on their own initiative to report past income and pay back taxes without penalty.

But the program is only valid if the taxpayer is not already on CRA's radar.

Tax experts told CBC News that KPMG clients should not have qualified as the agency was already auditing the Isle of Man tax-avoidance scheme as part of an investigation that dated to 2012.

"If CRA knows what you've done it's too late already," Laval University tax professor Andre Lareau told CBC News. "The CRA violated its own guidelines of voluntary disclosure," he said.

- Send confidential tips on this story to INVESTIGATIONS@CBC.CA, or contact Harvey Cashore at 416-526-4704

One of the biggest mysteries is who exactly at CRA made the amnesty offer.

The secret deal, leaked to CBC News in a brown envelope, was signed by CRA's manager of offshore enforcement, Stephanie Henderson, and sent to the accounting firm KPMG on May 1, 2015.

But there are conflicting stories as to whether Henderson, or her bosses, made the decision.

Sources tell CBC News that discussions about the KPMG case, which has been in operation for more than 10 years, went high up the line at CRA, far beyond Henderson.

The manager in the offshore division was reportedly holding almost daily briefings for a time in 2015 with high-level officials at the CRA.

"She was pissed that senior leadership backed off and a deal was struck," one source said.

When contacted at work by CBC News, Henderson referred a reporter to the media relations office.

CRA spokesperson Philippe Brideau echoed what assistant commissioner Ted Gallivan told CBC News on Friday — that there was no interference on the file from higher-ups, including from then assistant commissioner Richard Montroy, who was in charge of compliance.

"Officials responsible for the file have confirmed that there was no instance where Mr. Montroy provided direction," Brideau said in an email.

In his own email to CBC News Montroy said: "There were no instances where I failed to support the recommendations and actions of the people who worked in my branch."

Gallivan, the current head of compliance also disputes that there was any internal disagreement prior to the amnesty offer being made.

"We found no evidence of internal disorder or debate," he said.

Montroy 'approved' correspondence

Brideau also said the decision to make the settlement offer to KPMG and its clients was made strictly in the CRA's offshore compliance division, which reported to Montroy.

"Mr. Montroy, as assistant commissioner, was appropriately briefed and, in accordance with his responsibilities, approved any formal communications to KPMG," Brideau said in an email.

Montroy, who retired from the CRA last fall, declined to be interviewed by CBC News.

In an email he wrote, "I have not, nor have I ever, made any settlement offer in the KPMG case that you refer to."

"What I did do," he went on, "was provide appropriate oversight, when required, that compliance approaches were based on the facts and merits of the case and in keeping with CRA policies and the legal framework under which my branch operated."

Montroy also told CBC News he took no part in the discussions between KPMG and CRA on the audit into the Isle of Man offshore structure.

"I have never met anyone from KPMG, their legal representatives, or even our own counsel on this file for that matter. I let people do their job, and I was briefed on the progress of the file, as appropriate," Montroy said.

"I take great pride in the work I accomplished throughout my career. It was one built on integrity and honesty."

CRA commissioner played 'normal and required' oversight role

In an email to the CBC, the CRA's top executive, commissioner Andrew Treusch said: "I note in the strongest possible terms that, as the commissioner of the Canada Revenue Agency, I have never provided direction to CRA officials on the approach to be taken in the management of KPMG litigation or negotiations."

Rather, he wrote, "I have played my normal and required oversight role, which is to assure myself that the CRA's operational approach is grounded firmly by the facts and merits of each case and the legal framework within which the agency operates."

Treusch also said he has "never discussed the KPMG litigation, including any negotiations that may have occurred" with anyone at KPMG at any time.

CBC News had asked the commissioner whether he knew about the CRA's secret settlement offer before it was sent to KPMG.

Brideau, the CRA media spokesman replied: "The commissioner would not review or approve this type of letter as this task is the responsibility of operations managers at the agency."

For confidential tips on this story please email investigations@cbc.ca or contact Harvey Cashore at 416-526-4704, or visit CBC Secure Drop to send documents to the attention of Harvey Cashore.

with files from Katie Pedersen