Top CRA compliance official lobbied by ex-colleague to restrict auditor powers

CRA deputy discussed ‘non-legislative’ proposals for limits on federal tax authorities

A top Canada Revenue Agency compliance official was lobbied by a former CRA "special adviser" on tax compliance to place restrictions on how federal auditors obtain information from accounting firms, according to documents obtained by CBC News under Access to Information.

Emails and other records show that on Sept. 8, 2014, Ted Gallivan, the CRA's deputy assistant commissioner of compliance, met with a lobbyist for the Chartered Professional Accountants of Canada, Bill Dobson, himself a former CRA compliance adviser who moved from government to industry in early 2013.

Those records show a discussion about "non-legislative" rule changes relating to industry's desire to keep certain documents "confidential" between accountants and their clients.

Instead of seeking a new law that would require parliamentary approval, the two men discussed "administrative" changes that could be made within the CRA.

There is no information in the access-to-information documents about whether any of these proposals went further than the meeting.

- Canada Revenue offered amnesty to wealthy KPMG clients in offshore tax 'sham'

- Major accounting firms routinely recruited federal justice and CRA tax enforcement officials

- Senior federal tax enforcer joined KPMG as its offshore 'sham' was under CRA probe

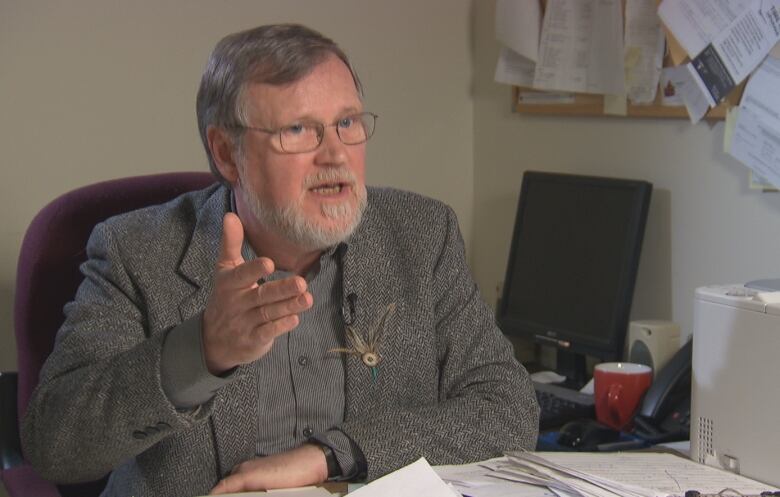

Gallivan, who would later become assistant commissioner of compliance, is now assistant commissioner of the CRA's international, large business and investigative branch. He is scheduled to testify before the Commons finance committee later today, along with other CRA officials, to face questions about the CRA's amnesty offer to KPMG clients caught using an offshore tax dodge.

CPA Canada, a nationwide tax industry association, has been lobbying government officials for years to restrict when accountants have to provide client information to tax authorities.

Three days after the September 2014 lobby meeting, industry representative Bill Dobson wrote an email to the CRA outlining his "understanding" of what was discussed with Gallivan and his assistant.

According to Dobson's version of the meeting, the CRA's Gallivan said there were concerns within his compliance programs branch coming from the "large case" audit group.

Gallivan said that a particular group of CRA bureaucrats believed implementing "confidentiality" for accountants and their clients could be a "significant impediment" to CRA's "right to information," Dobson wrote in his report.

- Send confidential tips on this story to investigations@cbc.ca, or contact Harvey Cashore at 416-526-4704

Dobson's note indicates Gallivan was "encouraged" to learn that CPA Canada was not asking for blanket confidentiality and supported disclosing some taxpayer/accountant documents, including what's known as "tax risk facts."

Dobson also wrote that "Ted agrees" the CRA's compliance branch should not be permitted to make decisions on its own about what to collect from accounting firms, but that the process should go through a third party within the agency. The note says there was discussion about involving CRA's appeals branch and making "changes to the audit manual."

Other ideas included requiring the CRA to provide a "supplemental information request" to explain why it was "necessary" to obtain documents from a taxpayer's accountant.

Neither Dobson nor Gallivan responded to CBC News for comment on the access-to-information documents or to discuss what happened, if anything, as a result of the September 2014 lobby meeting.

Gabe Hayos, vice-president of tax for CPA Canada and a former KPMG tax executive, told CBC News last year that the association had deliberately decided to pursue confidentiality protection through the Canada Revenue Agency instead of at the elected level.

"We have tried to see if we simplify it by not going the political route," he said. He added that if CRA was in agreement with confidentiality proposals for accountants and taxpayers, it would be "easier" to go to the next level of getting a legislative solution.

Hayos also told CBC News he hired Dobson because the former bureaucrat had held senior positions in the CRA, including its compliance division, and understood the CRA's inner workings.

Dennis Howlett, executive director of Canadians for Tax Fairness, wonders why CPA Canada is lobbying so hard for accountant confidentiality when the CRA doesn't publicly identify taxpayers under routine audit.

"CRA's going to keep the information confidential," Howlett said. "If they've got nothing to hide, if there's nothing improper being done, then why should they try to hide that?"

By the time of the September 2014 lobby meeting, court records show CPA Canada had already sought to intervene in the CRA court case to get the names of the KPMG clients involved in the alleged Isle of Man tax dodge — also on the principle of confidentiality.

CPA Canada has said it wasn't hoping to get involved in the court case to support KPMG's offshore scheme, but rather because it believes all Canadians have a right to confidential tax advice.

In his testimony before the Commons finance committee on Tuesday, KPMG's Gregory Wiebe echoed the same principle in refusing to reveal the names of the clients.

The CRA's case against KPMG moved to out-of-court discussions in October 2013 - before the industry association could receive official intervener status. In May 2015, the CRA offered a secret amnesty to the KPMG clients caught using the Isle of Man tax dodge, the details of which were leaked to CBC News in a brown envelope.

Industry lobbying nothing 'sinister'

David Chodikoff, a Toronto tax lawyer and author, says CPA Canada's lobbying of the Canada Revenue Agency is to be expected.

"I see it as an organization attempting to protect its membership, but also I think, rightfully so, trying to improve the relationship with the government in order to be to be more efficient and cost-effective," he said. "I don't see a sinister or some sort of underlying negative aspect to this. I really don't."

Chodikoff says CPA Canada routinely speaks to the CRA about a variety of issues.

"They're representing not just large companies, but they're representing all other professional accountants and certified general accountants," he said.

Access to Information documents also show Dobson lobbied Gallivan previously, on May 9, 2014. They discussed a variety of topics, including "the importance of settling audit cases."

CBC News has more than 25 outstanding Access to Information requests with the Canada Revenue Agency, most of them filed in the spring of 2015. To date, only a handful have been completed.

Commissioner Andrew Treusch didn't respond to an email question about the delay in responding to those requests.

CRA's Access to Information office told CBC News they have dedicated a person full-time to work on the requests.