Opponents of the Liberals' proposed tax reforms may not be telling the truth

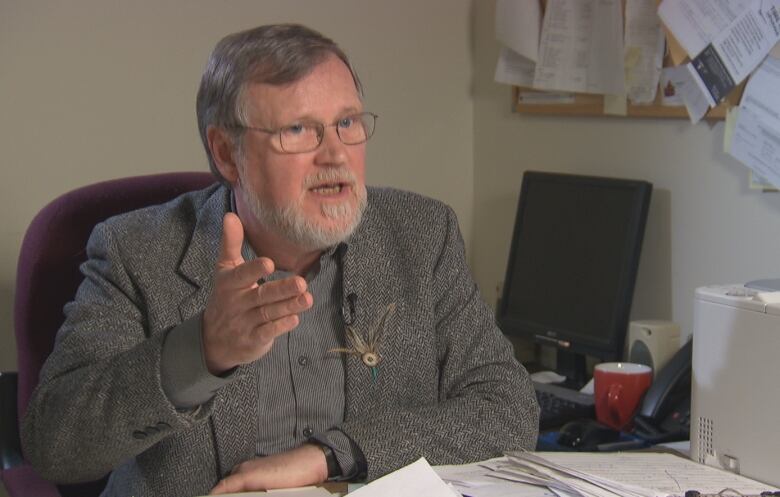

The opposition to the federal government's proposed tax reforms is based on misleading information. That is the view of Dennis Howlett, executive director of the lobby group Canadians for Tax Fairness.

Small business owners, including farmers and doctors, have been arguing that if these changes are implemented, they will constitute an attack on the middle class.

"You can't say, in any way, it's going to affect the middle class, and to suggest so is completely misleading. I fear we've got the importation of the American-style politics of lying coming to Canada, and I'm really alarmed by that," says Howlett.

"Some Canadian politicians think this is a good idea: let's just mislead people, who cares if there's any data to back up the claims."

"Rich doctors and the small business lobby groups have managed to convince many of the small business people who are not in fact affected at all, to jump on this bandwagon, by exaggerating the fears," Mr. Howlett says.

"Really, unless you're earning $150,000 or more, you're not going to be affected much at all."

Dennis Howlett's analysis of the proposed tax reforms is available here.

To hear his full conversation with Michael Enright, click 'listen' above.