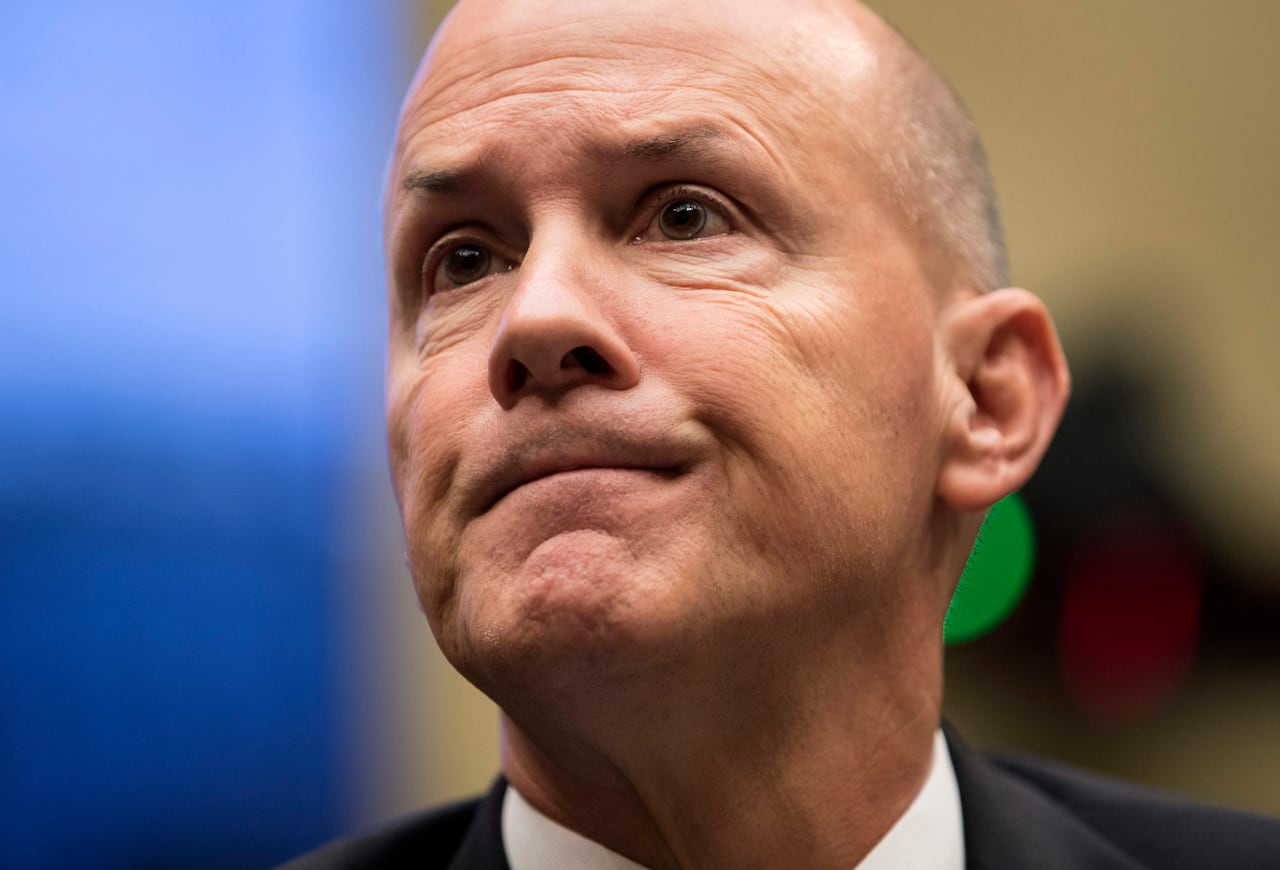

Meet the 'Monopoly Man' who photo-bombed former Equifax CEO

As former Equifax CEO Richard Smith testified before the Senate Banking Committee about the Equifax data breach yesterday, there was a surprising face behind him. The Monopoly Man ��— or Rich Uncle Pennybags.

In full costume, the Monopoly Man appeared in the frame, tugging at his moustache, adjusting his monocle and wiping his forehead with a dollar bill.

The Monopoly Man has now been identified as consumer protection advocate Amanda Werner, who says companies like Equifax have a monopoly on the justice system.

Werner spoke with As It Happens host Carol Off about the point behind the costume. Here is part of their conversation.

This just went viral, as they say, because it was just extraordinary that you should do that, and it was just so subtle just to sit there peering over his shoulder. What was the message you were trying to send?

I was trying to call attention to Republicans' get-out-of-jail-free card for Equifax and Wells Fargo. Right now Senate Republicans are trying to repeal an important consumer protection that ensures that we can sue banks and lenders like these companies when they break the law.

- Equifax data breach a 'digital disaster' for Canadians

- Canada's privacy commissioner opens probe into Equifax data breach

- 'We want answers,' lawmakers demand of Equifax ex-CEO Richard Smith

This is the way actually people would have to, if they wanted to get protection or get information, they have to sign on to this. Can you just describe what it was?

So Equifax is a great example of this. Right as they told everyone about the data breach, they directed people to this trusted ID site where they could get some sort of identity protection products. But buried deep in the terms and conditions of that website, it had what's called a forced arbitration clause.

What this clause does, [is] when you sue Equifax or another lender for dispute, basically instead of being able to join together in a public court system that our tax dollars pay for, you have to go into secret arbitration proceedings where Equifax gets to choose the firm that decides the case, and it's very hard to appeal a bad decision.

So any of these people who were affected by this data breach — if they wanted to sue Equifax — would have to first of all agree to the terms. And if they didn't do that, what would happen?

They wouldn't be able to use those services. So Equifax actually ended up taking out the arbitration clause after there was a lot of public outcry.

But they were a really good example because even though they got caught and ended up having to remove it, this is standard practice across banks, lenders and all three credit lenders. So consumers are signing these kinds of things every day. It's often buried in the terms and conditions of apps or contracts we sign.

What effect did your appearance have? Do you think that people got that message? Were you able to warn people about the existence of this forced arbitration clause that's used so often?

Yeah, luckily it seems like it worked pretty well. Obviously I think a lot of folks got a lot of comedy from it. I'm really glad that I was able to kind of brighten folks' day during an especially difficult week here in the U.S.

But I think the message got across as well. A lot of the coverage talked about what the issue was, talked about this get-out-of-jail-free card and talked about the senate repeal effort. So I think it really made a difference, and hopefully put this issue on people's radar in a way that will stop Republicans from rolling back these protections.

Now while you were sitting there behind Richard Smith adjusting your monocle and mopping your brow with the hundred dollar bill, he was testifying that it was a human error; a technological error. He apologized, but he said he's still kind of evaluating. He says he takes full responsibility even as he retires. What do you make of what he had to say while you were behind him?

He ended up basically saying it was the human error of one person. And I think any time your entire security apparatus is resting on one person, human error goes much deeper. I didn't appreciate him trying to kind of throw employees under the bus instead of taking full responsibility himself.

And did he know you were sitting behind him this whole time?

People have been asking that, and I wasn't sure. But I actually just saw a video last night of the very beginning of the hearing, and there's a moment when he looks back at me and then kind of looks stunned. So I do think he knew I was there. I don't know if he had any idea what I was doing behind him.

And is Mr. Monopoly, or Rich Uncle Pennybags, going to make any future appearances in Washington?

I would say keep an eye out, you know. I'm warning Mitch McConnell right now: if he decides to try to push this vote again, Mr. Monopoly will absolutely pop up to try to put an end to it.