Ontario launches audits of 6 municipalities to look at how housing law will affect budgets

3rd-party audits expected to measure impact to changes in development fees

The Ontario government says it has chosen an auditor to analyze the finances of six municipalities to learn how their budgets will be affected by a housing law that was passed last year.

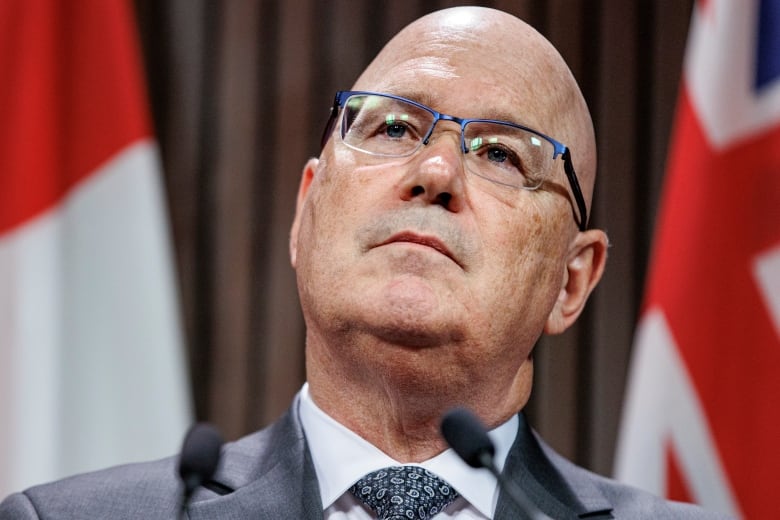

Municipal Affairs and Housing Minister Steve Clark said in a news release Wednesday the province had selected accounting firm Ernst & Young LLP to audit the City of Toronto, Peel Region, Mississauga, Caledon, Brampton, and Newmarket.

"The audits will help provide a clear and shared understanding of the impacts of changes to development-related fees and charges included in the More Homes Built Faster Act," Clark said.

The More Homes Built Faster Act, which passed in November, froze, reduced or exempted developers from paying fees municipalities charge them for some types of housing, including affordable housing, non-profit housing and inclusionary zoning units — meaning affordable housing in new developments — as well as some rental units. Development charges can continue to be levied on most market housing.

The changes were meant to reduce construction costs and incentivize developers to build more housing, as the province seeks to construct 1.5 million homes by 2031.

Development fees needed to fund infrastructure: Municipalities

Money collected from the fees go to municipalities to pay for infrastructure to support new homes, such as roads and sewers. Under the principle that "growth pays for growth," municipalities use development charges and other fees to cover the costs of infrastructure required to accommodate new residents.

When the bill was introduced, municipalities across the province raised concerns that the changes would blow a hole in their budgets and limit their ability to build the infrastructure needed to service new developments.

The Association of Municipalities of Ontario said the changes could leave municipalities short $5 billion and see taxpayers footing the bill — either in the form of higher property taxes or service cuts — and that nothing in the bill would guarantee improved housing affordability.

The City of Toronto estimated it stood to lose an estimated $230 million a year in development charges, community benefits charges and parkland levies if the bill passed.

Clark argued at the time the fees drove up construction costs for developers, who then pass those added costs on to homebuyers in the form of higher prices. He promised to make municipalities "whole" if they can't fund housing infrastructure and services due to the changes.

In Wednesday's release, the province said the audit will also look at "municipal financial management practices" in addition to examining the financial impact of Bill 23 on municipal finances.

"We want to ensure development-related charges and fees are being used in a manner that supports increased housing supply and critical housing-related infrastructure, but which does not unduly raise the cost of finding a home for hardworking Ontarians," Clark said in Wednesday's release.

Ontario's big city mayors welcome audit

In a statement, an umbrella organization that includes the mayors of 29 municipalities with a population of 100,000 or more, welcomed the selection of Ernst & Young.

"We welcome these audits and know they will demonstrate that municipalities are prudent with tax dollars, directing them to essential services in our communities," said Marianne Meed Ward, chair of Ontario's Big City Mayors (OBCM) and Mayor of Burlington.

"We look forward to the audit results that can be used by the province, as promised, to keep municipalities whole from the financial impacts of Bill 23."

OBCM said it believes the outcome of the audits will show the "significant financial impact" the changes will have on services and on the current model for funding growth.

The province said it expects the first phase of the audits to be completed around the end of 2023.