University of Ottawa student told to repay $12K from CERB says he was given bad info

Alex Coucopoulos among tens of thousands of Canadians who've received government letters advising repayment

A University of Ottawa student who owes the federal government $12,000 is blaming the big bill on bad information he received when applying for Canada's emergency pandemic benefits.

Alex Coucopoulos, a third-year student, lost both his part-time job and a summer co-op position with Global Affairs Canada due to the COVID-19 pandemic.

When he inquired about applying for the Canada emergency response benefit (CERB), he was told by a Canada Revenue Agency (CRA) agent that as long as he'd made more than $5,000 in 2019, he would qualify.

Later, when the Canadian emergency student benefit (CESB) became available, Coucopoulos said he checked back in with the CRA to see if he should switch streams and was told CERB remained the better option.

Based application on gross income, not net

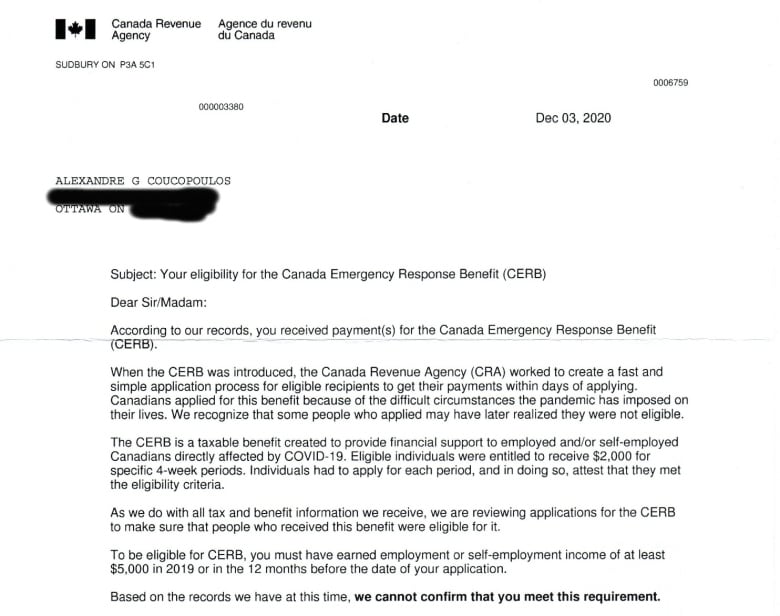

Now Coucopoulos is among the tens of thousands of Canadians who've received letters from the CRA stating they may never have been eligible for the CERB benefits they received.

He told CBC News he figured he met the threshold since his gross income for 2019, including student bursaries, was above $5,000, an interpretation the CRA agent said was correct.

However, the CRA's letter says student loans and bursaries do not count toward employment income.

"I called them and I made sure that I [did] the work that I need to do to make sure I'm eligible for it," Coucopoulos said.

The CRA's letter advises Coucopoulos to repay the $12,000 in benefits he received by the end of December, although it notes he may have made an "honest mistake" and says no penalties or interest would be charged if he missed that date.

The federal government has acknowledged that it provided unclear instructions when the CERB program was being rolled out, including the information provided to call centre agents.

Coucopoulos said when he called CRA about the letter, he was told he should have applied for the student benefits program instead. He said he asked if he could pay the difference between the two programs — which would save him about $5,000 — but was denied.

Coucopoulos said the government's acknowledgment just adds to his frustration.

"I'm trying to own up to it and say that I'll pay the difference. I'm expecting the government — who, you know, supposedly is supposed to help people that need their help — to own up to their mistake too."

Taxpayers federation say it's unfair

The Canadian Taxpayer Federation has been outspoken about the need for the government to crack down on fraud in the benefits, but said this situation is a fine line to walk.

"On the one hand, we don't want to see people who deliberately defraud the system get off the hook," said Aaron Wudrick, the federation's federal director.

"But on the other hand, if people didn't mean to, you know, I don't think that they should be treated the same way."

In a year-end interview with CBC, Prime Minister Justin Trudeau said the government would work with people who'd received overpayment letters on a case-by-case basis, but wouldn't commit to cancelling the repayments outright.

"You don't have to repay during Christmas," Trudeau said. "You don't have to think about Jan. 1 as any deadline, and we're going to work over the coming weeks and months to make sure that there's a path forward that makes sense."

Clarifications

- A previous version of this story said eligibility for CERB was based on net employment income. That is true in the case of self-employed individuals, but not for all people.Dec 21, 2020 8:10 PM ET